Under the trend of new energy, the wind brand has also brought its latest new energy model – the wind blue electric E5, which is also the first batch of models deeply equipped with Huawei Hicar 3.0 and will be launched in the first quarter of this year. At the same time, this car is also equipped with a hybrid system provided by BYD Freddy, with a comprehensive battery life of an astonishing 1150km. Next, let’s take a look at the highlights of this new car.

In terms of exterior design, the Landscape Blue Electric E5 adopts the latest family-style design language. The front face is shaped with an oversized air intake grille, and the interior is decorated with dot matrix elements. Officially, it is called a star dot matrix digital grille, and it is highly recognizable with skyline LED light strips.

The black chrome strip above the grille can clearly see the logo of the English letter "E", which presents the ecological meaning of the Internet of Everything through the artistic arrangement of nine dots, which complements the large-scale starlight dot matrix digital grille.

The sharp waistline of the side body is slightly raised upward, which enhances the power atmosphere. The chrome luggage rack on the roof, plus 19-inch low wind resistance design rims, perfectly interprets the sense of sports and fashion. The new car is positioned in a medium-sized SUV, and its body length, width and height are 4760/1865/1710mm, and the wheelbase length is 2785mm. The body height is more advantageous than that of the same class.

The layering of the rear of the Landscape Blue Electric E5 is outstanding. It adopts the current mainstream through-type taillight group design, and the LOGO logo is displayed above to improve the brand’s recognition. The large-sized spoiler at the D-pillar position, combined with the hidden exhaust layout below, is also in line with the design ideas of most hybrid and new energy models.

The interior design of the Landscape Blue Electric E5 adopts the current mainstream technology minimalist style, and the cockpit has a clear sense of hierarchy. In order to highlight the luxurious atmosphere, the new car is decorated with chrome-plated strips and wood grain style trims in the material, creating a strong sense of class.

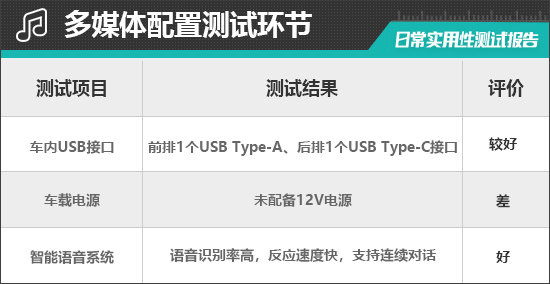

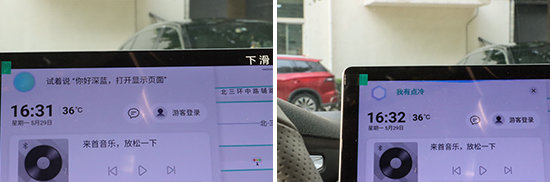

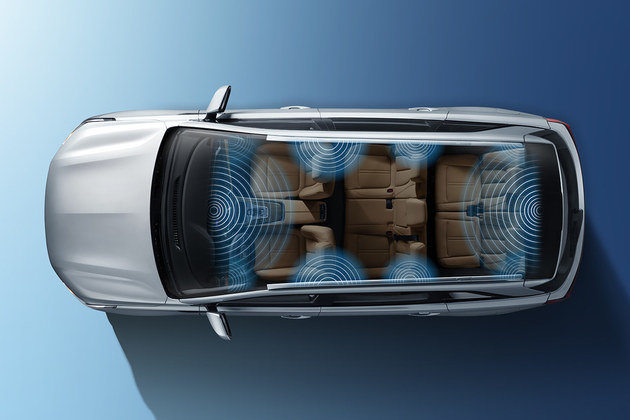

At the same time, the new car is also equipped with a dual-format multi-function steering wheel and an integrated screen composed of a full-LCD instrument and a large-size central control screen, which is still very technological. In addition, one of the major selling points of the Landscape Blue Electric E5 is the Huawei HiCar 3.0 system, which is also equipped with a sound system composed of 12 speakers. The unique acoustic design realizes 360 ° full-scene surround sound, bringing users an immersive listening enjoyment.

The smart air purification function is also essential, with both PM2.5 sensors and negative ion generators, which are more popular configurations.

In order to ensure comfort, the Landscape Blue Electric E5 provides a full-body curved seat, providing better support for the body and providing maximum comfort for long-distance travel.

Thanks to the flexible and changeable "5 + 2 seat" space layout in the car, the front seats can be reclined 165 degrees backward, and the second and third rows of seats can also be laid flat, making it a super wide viewing room for outdoor leisure.

In terms of riding space, thanks to the flat roof design, the 1.80-meter-tall ride has the seat adjusted to the lowest level, and the front and second rows of head space can reach the margin of one punch. The third row of head and leg space is cramped, and if you want to leave room for the legs, you need to coordinate with the second row of seats.

After the rear seats are reclined, you can have an amazing 934L of trunk space, so you don’t have to worry about traveling with your baby. Even when the seats are fully used, the blue electric E5 trunk has a capacity of 187L, which can meet the basic practicality.

Recently, in the intelligent cockpit certification of the China Automotive Center, the Scenic Blue Electric E5 successfully passed the comprehensive test of 18 sub-items in the four dimensions of functionality, speed, convenience and intelligence of the vehicle’s in-vehicle voice interaction system, and obtained the A-level certificate of the in-vehicle voice assistant, becoming the second model to obtain this certification after the M5.

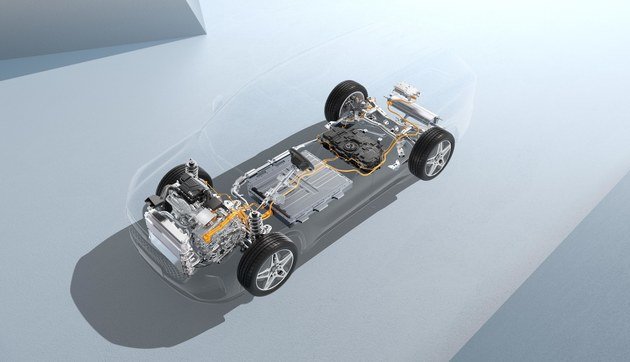

In terms of power system, the Wind Blue Electric E5 is equipped with a 1.5L high-efficiency plug-in hybrid special engine and a DHT300 electric hybrid system produced by Freddie Power. It has a 15.5:1 ultra-high compression ratio, a maximum thermal efficiency of 43.04%, and a maximum transmission efficiency of 97.5%. According to the official introduction, the new car’s 0-50km/h acceleration time is 2.9 seconds, and the WLTC comprehensive cruising range is as high as 1150km.

The new hybrid technology of Landscape Blue Electric E5 integrates fuel consumption, smooth handling, quiet driving, and fast speed, perfectly taking into account the main needs of users during driving. The fuel consumption of WLTC 100 kilometers feed is only 5.5L. Using EV mode at 60km/h, the noise in the car as low as 54.8 decibels can also make the driver feel luxurious and comfortable.

The blue electric E5 is also equipped with external discharge function, and its maximum external discharge power of 3.3kW is fully sufficient for outdoor camping, even if the outdoor electric hot pot and induction cooker are no problem.

The Wind Blue Electric E5 will also provide users with a new hybrid tram experience of "electric priority, electric drive mainly" under the technological innovation of the DE-i super electric drive intelligent platform of Cyrus Group.

With high recognition, efficient power, and no battery life anxiety, coupled with the blessing of Huawei and BYD technologies, it can be said that the product strength of the Scenic Blue Electric E5 is relatively comprehensive. If this car can be priced satisfactorily, I believe it will perform well in the market in the future.

For users who are eager to enjoy the driving experience of electric vehicles and want to put aside the worries of battery life, the launch of the Scenic Blue Electric E5 is undoubtedly another option for consumers. What do you think of this car? Express your opinion in the comment area.