Some time ago, Taiwanese netizens came across Peng Yuyan walking his dog at the Tianmu House in Taipei.

He was wearing a black cap, a black T-shirt and slacks.

It looks very low-key, without a bit of celebrity style, and you can’t recognize it if you don’t look carefully.

The name "Peng Yuyan" has not been mentioned for a long time.

It seems that since a few years ago, he has suddenly disappeared and rarely appeared on the screen.

In recent years, he has not produced any new works, and he has hardly been seen on major red carpets or events.

That lazy and casual look is like retiring early.

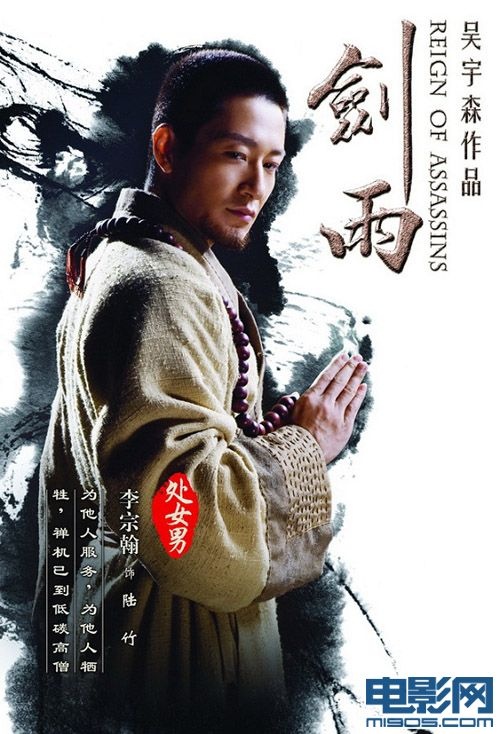

You know, the former Peng Yuyan was a popular "national male god".

And now that he is only 41 years old, he has disappeared, and there is almost no such person.

So, from the national male god to his disappearance, why did Peng Yuyan suddenly stop being popular?

Reason 1: Offend Li Bingbing

There have been rumors in the circle that Peng Yuyan was banned because he offended Li Bingbing.

Regarding the "grudge" between the two, it has to start with an event in 2018.

In 2018, the stars gathered on Weibo night, including Li Bingbing and Peng Yuyan.

At that time, Peng Yuyan was a popular student in Taiwan, but he was still a long way from the first line.

And Li Bingbing is the "first sister", which is highly praised by capital, and the resources have always been very good, and she is a good front line.

When attending an event, arranging seats and seating according to the coffee spot is a well-known "unwritten rule" in the circle.

The higher the popularity, the stronger the capital behind it, and the higher the position.

The larger the coffee position, the higher the status, and the closer it is to the C position.

On Weibo night, Li Bingbing’s original position was arranged in the first row.

Peng Yuyan’s seat was in the second row.

As a result, Li Bingbing’s position was changed to the second row, while Peng Yuyan sat in the first row.

After being replaced by the nameplate to seize the seat, Li Bingbing was so angry that she did not take a seat and kept standing backstage.

Even when Li Bingbing was on stage to receive the award, she was also brought up from the backstage.

Although there was a smile on his face after winning the award, he could still detect the displeasure of being robbed of the seat.

As the "seat grab" fermented, many people complained about Peng Yuyan.

In particular, Li Bingbing’s fans feel that their idol has been wronged.

Li Bingbing’s support will be even more insinuating, directly dissing Peng Yuyan with words.

As public opinion intensified, Peng Yuyan’s studio issued a statement:

On the day of the event, the artists attended the event with the crew. They were unaware that the seats at the event site were temporarily adjusted and cooperated with the arrangement to be seated. After learning about the incident, the artists themselves and the team immediately apologized to the seniors and the team who designed it, and thanked the seniors for their generosity and the team’s trust and understanding.

Although Peng Yuyan’s studio issued an apology and threw the pot to the event organizers.

In addition, he also paid attention to Li Bingbing, wanting to gain understanding and peace of mind.

However, Li Bingbing’s fans did not buy it. They were full of anger and opened the crazy mode as always.

However, Li Bingbing was more magnanimous, not only returning to Peng Yuyan, but also not mentioning the matter again.

Since the parties didn’t say anything, the fans on both sides naturally stopped a lot.

When he thought things would come to an end, Peng Yuyan took a downhill path, and his resources were not as good as before.

Later, he was at the edge of the entertainment industry, and suddenly the "light circle" was no longer popular.

For a moment, all kinds of guesses arose.

The most common theory is that Li Bingbing forgave Peng Yuyan on the surface, but she was still very angry inside.

Therefore, as the first sister, she relied on her extensive network and used the power of capital to ban him.

Could it be that Peng Yuyan’s "disappearance" was really just because he offended Li Bingbing?

In fact, this is not the case. In addition to this reason, there are multiple factors.

Reason 2: The acting is not good, but there are a lot of scandals

Sometimes, in the face of absolute strength, capital will also consider making concessions for you.

If Peng Yuyan’s acting skills were outstanding and his strength was strong, he would not be abandoned by capital so quickly.

Obviously, his acting skills have always been controversial, and no excellent acting skills or works can win over audiences.

Even if the acting is not good, there are still a lot of scandals.

His private life is much more exciting than his work, attracting a lot of attention by hype.

Peng Yuyan said that he doesn’t like to hype his relationship, but he is also obsessed with peach scandals.

There were previous revelations that Peng Yuyan had talked to Cai YL, which was also confirmed by Peng Yuyan’s agent.

The two met in 2006 and fell in love quickly, secretly dating for three years due to various considerations.

During their relationship, the two were constantly blocked by the company, and with Peng Yuyan’s scandal, the two finally broke up.

It is said that when Peng Yuyan and Cai YL were in love, he carried Miss Cai and oxygen beauty Lin Jiaan to the dark.

Some media have photographed Lin Jiaan staying at Peng Yuyan’s house for two hours, and some have revealed that the two are dating.

Although many "cohabitation photos" were taken, the two held the attitude of "beating to death and not admitting it".

Peng Yuyan also had an affair with Big S, and the two became attached to "The Voice Practice of Love".

Before the filming was over, the scandal between the two was flying all over the sky.

They not only flirted on set, but also were very ambiguous when attending events.

However, later, the two sides agreed that they were oolong and did not call.

In 2011, Peng Yuyan and Shu Qi went to a nightclub together late at night to be happy to be photographed, which led to a love affair.

The two met because of filming the MV, and Peng Yuyan would send birthday wishes to Shu Qi on time every year on Shu Qi’s birthday.

Peng Yuyan has shown his liking for Shu Qi in front of the media many times, and also called Shu Qi his own Muse.

Taiwan media once broke the news that the two had a relationship, but Peng Yuyan was not famous at that time, so it did not attract much attention.

In 2013, Peng Yuyan and Bai Baihe collaborated on "Break Up Contract", and the two were accused of falling in love due to the play.

Later, when Bai Baihe and her husband divorced, the scandal between Peng Yuyan and Bai Baihe was also noisy.

Peng Yuyan can be said to be filming a play for a gossip girlfriend.

In 2014, Peng Yuyan and Guo Caijie were rumored to have an affair for filming "Love Close at Hand".

In addition, Peng Yuyan has also been rumored to have affairs with actresses such as Zhang Junqian and Xu Qing.

Peng Yuyan and Zhang Junyu filmed "I am in Kenting, the weather is fine" together, and cooperated with Xu Qing on "Evil does not suppress good".

I don’t know if it’s to deliberately create scandals for publicity and hype, or if actors are too easy to "fall in love with the play".

Anyway, Peng Yuyan’s reliance on a basket of "love" has attracted a lot of attention.

Due to the rich personal relationships, some people ridiculed Peng Yuyan for "more gossip girlfriends than works".

Reason 3: Most works are flexing their muscles and cannot afford the box office

No doubt, some aspects of Peng Yuyan are just passable.

For example, his acting skills need to be improved, and his personal relationships are too confusing.

But his figure is really amazing.

Jiang Wen once said that Peng Yuyan is not an ordinary person, and his self-discipline is very strong.

A body like his is more beautiful than an ancient Greek sculpture, why don’t I take a picture?

In other words, Jiang Wen approached Peng Yuyan to film, not for his acting skills, but for his figure.

As a result, there is Peng Yuyan’s "wonderful performance" in "Evil Does Not Suppress Upright".

In fact, Peng Yuyan didn’t show off his figure at the beginning of filming.

The first time he was noticed was because he starred in the role of Tang Yu Xiaobao in "The Legend of Immortals and Swords".

The fairy sword made Hu Ge and Liu Yifei popular, and Peng Yuyan, as a supporting actor, also began to emerge.

In the following years, he starred in a number of film and television works, but they were all tepid.

It was not until around 2010 that Peng Yuyan became inexplicably popular because he liked to take fitness photos.

In the past, when he was studying, Peng Yuyan was a little fat man.

Because he was too fat, he was often laughed at by his classmates. He felt inferior and didn’t dare to talk to the girl he liked.

So later, he made up his mind to lose weight and entered the entertainment industry by chance.

After learning the story behind Peng Yuyan’s fitness, many people praised him.

Praise him for his self-discipline and admire his ability to develop from a fat man to a muscular man.

In 2011, Peng Yuyan received an invitation from the crew of "Roll! Ashin".

In the film, Peng Yuyan began to show off his figure, but he didn’t expect a good response.

After that, Peng Yuyan took the tough guy route and walked farther and farther on the road of showing off his figure.

In films such as "Operation Mekong", "Guild War", and "Evil Does Not Suppress Upright", his strong body can be seen.

With his unique appearance, Peng Yuyan won a group of fans and the title of "National Male God".

Unfortunately, things must be reversed, and showing too much can also cause visual fatigue.

Without excellent acting support, relying solely on one’s body to attract attention will not last long.

Peng Yuyan is very hard-working and inspirational.

But his acting has been stagnant, without much progress.

Peng Yuyan has never denied the shortcoming of "acting":

"I didn’t get the hang of acting, it’s always been like this. When I get a feeling, I don’t know how to act. I feel this way every time. Can I act? I don’t understand this at all."

After eating the bonus of the figure, the capital found that Peng Yuyan could not afford the box office at all.

In recent years, the films starring Peng Yuyan have not been as good at the box office every year.

Either the rating is low, the box office is low, or the street is double.

In 2017, "The Legend of Wukong" 698 million at the box office, with a rating of only 5.1.

2020’s Emergency Rescue 485 million at the box office with a 5.9 rating.

The 2021 "First Incense" box office 64.21 million, with a rating of 5.0.

The rating failed again, and word-of-mouth box office double hit the street.

Also in 2021, "Tropical Past" 64.09 million at the box office, with a rating of 6.2.

This is Peng Yuyan’s highest-rated film in the past six years, and he has finally entered the passing line.

However, the box office was unsatisfactory and suffered a terrible loss.

Unable to afford the box office, and without the support of excellent works and acting skills, there are more and more bad films.

What’s more, Peng Yuyan is already over 40 years old and no longer young.

There was nothing in his body worth the capital investment.

It is inevitable to lose value and be abandoned by the times and capital.

And it turns out that when times and capital abandon you, they won’t say hello.Peng Yuyan is the best example.

Reason 4: Issues of nationality and position

If only the above three reasons are not enough to make Peng Yuyan "disappear".

After all, many actors in the circle also have bad word-of-mouth, bad box office, and chaotic lives.

People still eat leftovers in the circle, as long as they are thick-skinned enough.

The last "straw" that crushed Peng Yuyan was his "position".

With the rapid rise of the mainland economy, the scale of the entertainment market is also expanding year by year.

The prosperity of the mainland market and unlimited business opportunities have attracted a large number of Hong Kong and Taiwan artists to flock to the mainland for development.

In order to better extract gold in the inland, many artists have taken a stand and forwarded that there is only "one China".

However, Peng Yuyan was caught, and he not only did not forward it.

And he also made some remarks on overseas platforms that were not conducive to unity.

Back then, Peng Yuyan was promoting his movie "Guild Wars".

Two posts were posted on foreign social media platforms in Chinese and English.

He first sent a Chinese message saying that Guild Wars will be released in Hong Kong today, China tomorrow, and Taiwan in September.

Then I sent it again in English.

Referring to the mainland as China, Hong Kong and Taiwan alone said that this move caused netizens to explode, and netizens commented:

"It should be said that Hong Kong, Taiwan and the Chinese mainland should not be juxtaposed with China."

"In fact, many Taiwanese artists pretend to be very patriotic to make money."

"No matter how good the actors are, on the one hand, insisting on one China is the bottom line."

Perhaps seeing the skepticism and public outrage, Peng Yuyan’s team immediately offered an explanation and public relations.

However, netizens did not buy it, thinking that he was "pretending to be wrong" for the money.

If you want to make money in the mainland and don’t support one China, it will only be ambiguous. Isn’t this right and right?

After this incident, everyone’s affection for Peng Yuyan fell to the bottom.

Some people even expressed their refusal to watch his movies, wondering if Peng Yuyan’s later box office was dismal due to this factor.

Today, Peng Yuyan is already 41 years old. Abandoned by capital and spurned by everyone, it is difficult for him to have another chance to become popular.

From the national male god to the disappearance, everything is traceable.

Responsible editor: