After a lapse of three months, Wanda Real Estate Group has become a "dishonest person" again.

Recently, according to the China Enforcement Information Disclosure Network, Wanda Real Estate Group Co., Ltd., Heyuan Yuhai Real Estate Development Co., Ltd., and Heyuan Fuxin Construction Co., Ltd., refused to perform the obligation to determine the effective legal documents due to their ability to perform, and were listed as dishonest persons subject to enforcement by the Shanghai Second Intermediate People’s Court (hereinafter referred to as "dishonest persons"), involving a domestic non-foreign-related arbitration award. Not long ago, due to the arbitration case, the above companies have been forcibly executed for more than 18.87 million yuan.

It is worth mentioning that in April this year, Wanda Real Estate Group and other non-foreign-related arbitration awards have been listed as dishonest persons subject to enforcement once.

Dalian Wanda Group is in constant trouble. In addition to Wanda Real Estate, Wanda’s commercial management-related equity has also been frozen recently.

Due to 18.87 million, Wanda Real Estate has once again become a "dishonest person"

Tianyancha shows that recently, Wanda Real Estate Group Co., Ltd. (referred to as "Wanda Real Estate") and its Heyuan Yuhai Real Estate Development Co., Ltd. and Heyuan Fuxin Construction Co., Ltd. added a new information on the person subject to execution, and the execution target 18.87 million Yu Yuan, which was listed as a dishonest person subject to execution by the Shanghai Second Intermediate People’s Court.

Tianyancha App shows that Wanda Real Estate was established in February 2018 with a registered capital of about 4.05 billion yuan, and the legal representative is Qu Xiaodong, jointly held by Shenzhen Dixun Industrial Co., Ltd. and Futai (Hong Kong) Investment Co., Ltd. with a shareholding ratio of 98.7% and 1.3% respectively. Shenzhen Dixun Industrial Co., Ltd. is 100% owned by Wanda general merchandise. The predecessor of Wanda general merchandise group was registered in Hong Kong by Wang Jianlin in the early years. Dixun investment.

It is worth mentioning that Wanda Real Estate in April due to non-fulfillment of 245 million has been listed as a dishonest person to be executed once, and was restricted from high consumption.

According to the data, on April 4 this year, due to the application of the applicant China Fuxing Co., Ltd., the court officially filed the case, mainly because Wanda Real Estate failed to perform the payment obligations determined by the effective legal documents within the period specified in the notice of execution in the domestic arbitration award case. Subsequently, Wanda Real Estate Group, Heyuan Fuxin Construction Co., Ltd., and Heyuan Yuhai Real Estate Development Co., Ltd. became the executors.

It is understood that the reason why Wanda Real Estate became a "dishonest person" was due to the real estate project planted in Heyuan, Guangdong, which was sued by its former partners. In April this year, the court listed as the person subject to execution, in addition to Wanda Real Estate, also includes Heyuan Yuhai Real Estate Development Co., Ltd. and Heyuan Fuhai Real Estate Development Co., Ltd. are 100% owned by Wanda Real Estate. Among them, Heyuan Yuhai Real Estate Development Co., Ltd. is Heyuan Yuhai Real Estate Development Co., Ltd. and China Fuxing Co., Ltd. hold 90% and 10% respectively. This time Wanda Real Estate is sued by China Fuxing Co., Ltd.

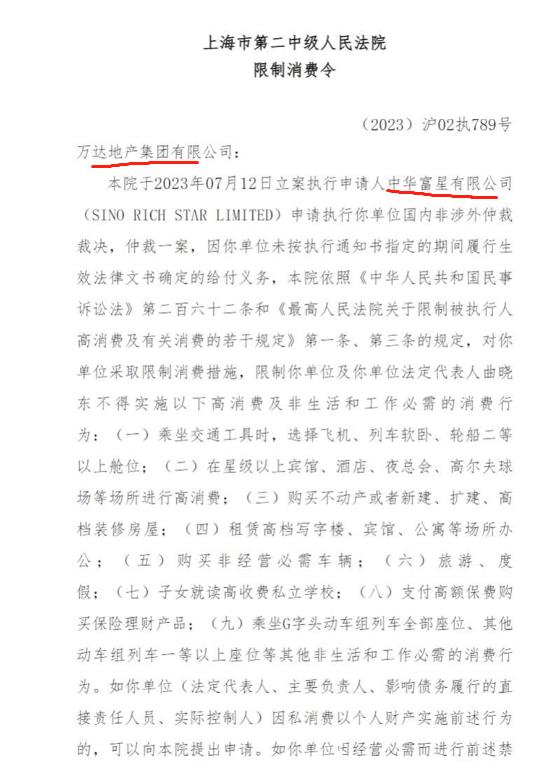

On July 24, the Shanghai Second Intermediate People’s Court issued a consumption restriction order showing that the court filed a case on July 12, and the enforcement applicant was still China Fortune Star Co., Ltd., applying for the enforcement of Wanda Real Estate’s domestic non-foreign-related arbitration award. In the case of arbitration, the court issued a consumption restriction order because Wanda Real Estate failed to fulfill the payment obligations determined by the effective legal documents within the period specified in the execution notice.

As of now, Tianyancha shows that Wanda Real Estate has multiple information on the person being executed, and the cumulative execution is about 265 million yuan.

Wanda’s commercial management stake has also been frozen

Tianyancha App shows that recently, Zhuhai Wanda Commercial Management Group joint stock company (referred to as "Wanda Commercial Management") added two equity freezing information, the executor is Dalian Wanda Commercial Management Group joint stock company, the amount of frozen equity is 5.072 billion and 100 million, Zhuhai Wanda Commercial Management is the main body of Wanda Hong Kong IPO, and Dalian Wanda Commercial Management is the largest shareholder of Zhuhai Wanda Commercial Management.

According to public information, the above freezing period is from July 4, 2023 to July 3, 2026, and from July 5, 2023 to July 4, 2026, respectively. The enforcement courts are the Zhanjiang City Intermediate People’s Court of Guangdong Province and the Dezhou City Intermediate People’s Court of Shandong Province.

It is worth mentioning that Zhuhai Wanda Commercial Management has submitted its IPO application to the Hong Kong Stock Exchange for the fourth time. Previously, in October 2021, April 2022 and October 2022, Zhuhai Wanda Commercial Management submitted listing application materials to the Hong Kong Stock Exchange three times, but ultimately failed to list.

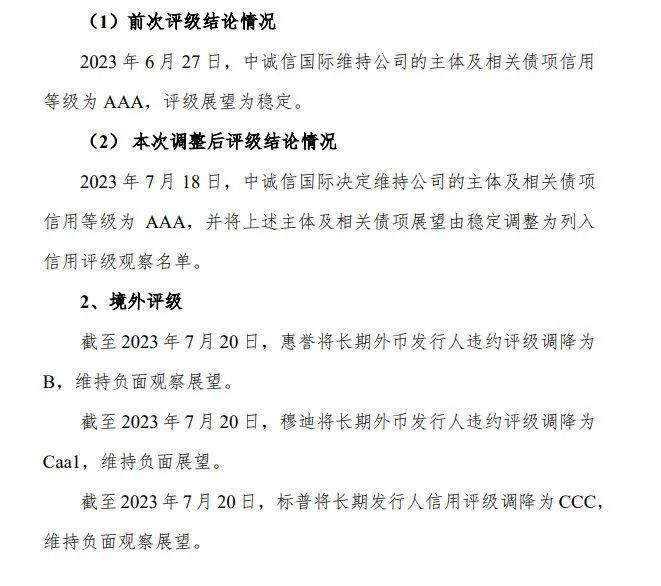

On July 20, Wanda Commercial Management announced that in terms of ratings, on July 18, China Chengxin International decided to maintain the credit rating of Wanda Commercial Management’s main body and related debt as AAA, and adjusted its main body and related debt outlook from stable to included in the credit rating watch list. The previous rating outlook was stable.

In terms of overseas ratings, as of July 20, Fitch downgraded its long-term foreign currency issuer default rating to B, maintaining a negative outlook. Moody’s downgraded its long-term foreign currency issuer default rating to Caa1, maintaining a negative outlook; Standard & Poor’s downgraded its long-term issuer credit rating to CCC, maintaining a negative outlook.

The reasons for the adjustment of the above rating agencies are mainly due to the fact that the refinancing channels of Wanda Commercial Management’s open market have not been restored, the continuous net repayment of maturing debts, the listing progress of its subsidiary Zhuhai Commercial Management is less than expected, and some of the equity held has been frozen, etc. Liquidity pressure has increased.

关于作者