In response to the short-selling agency’s report that Evergrande had never made a profit, China Evergrande announced on the Hong Kong Stock Exchange on the morning of December 4 that the report had no actual basis.

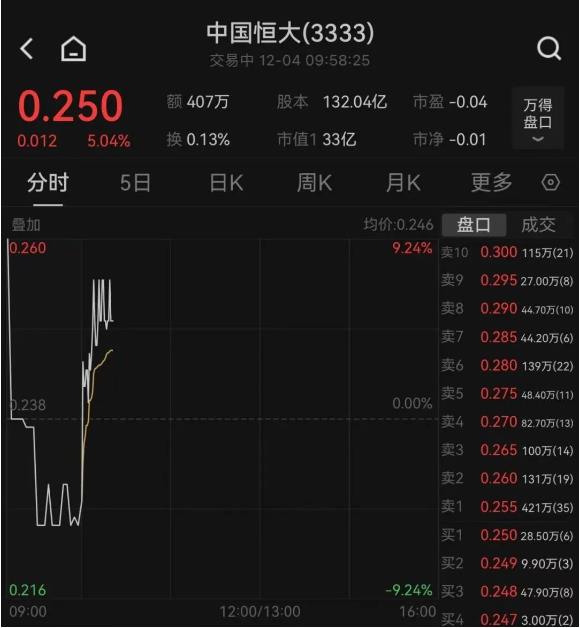

On the morning of December 4, China Evergrande Hong Kong shares fell by more than 4%. As of 9:56, China Evergrande Hong Kong shares rose by more than 5%.

Evergrande will further clarify

On the morning of December 4, China Evergrande issued a clarification notice on the Hong Kong Stock Exchange, stating that the company noticed that an institution published a report on December 1, 2023 that the company had never made a profit. The report has no actual basis, and the company will further clarify the content of the report later.

On December 1, GMT Research, a short-selling agency, published a report that pointed out that the delayed release of China Evergrande’s 2021 annual report clearly reflects the company’s obvious exaggeration of revenue and profitability, and it is likely to continue to exaggerate for many years. Evergrande may have basic problems or even never made a profit.

Operating loss in the first half 17.38 billion yuan

On August 27, China Evergrande released its semi-annual report for 2023. During the period, revenue was 128.20 billion yuan, an increase of 44% year-on-year; gross profit was 9.80 billion yuan, an increase of 38% year-on-year. During the period, the operating loss was 17.38 billion yuan, the non-operating loss (including litigation, land recovery, equity disposal and other losses such as asset appraisal impairment) was 15.03 billion yuan, and the income tax expenditure was 6.84 billion yuan. The total net loss was 39.25 billion yuan. In addition, Evergrande’s cumulative sales so far this year are about 40.50 billion yuan, an increase of 123% year-on-year. As of June 30, Evergrande’s land reserves reached 190 million square meters, and there were 78 old renovation projects (34 in Shenzhen).

A few days ago, China Evergrande disclosed the update announcement of Evergrande Real Estate involving major litigation and failure to pay off due debts. The announcement shows that as of the end of October 2023, Evergrande Real Estate had a total of 2002 pending proceedings with an amount of more than 30 million yuan, and the total amount of the underlying amount was about 470.755 billion yuan. As of the end of October 2023, Evergrande Real Estate had completed a total of 75 real estate projects through equity transfer, land and construction transfer, trust, and holding.

During October 2023, Hengda Real Estate added 100 pieces of information to be executed as of the deadline set out in the previous announcement, and the total amount of new execution was about RMB 6.617 billion yuan.

As of the end of October 2023, Hengda Real Estate and its subsidiaries within the scope of the merger involved a total of about 301.363 billion yuan in unliquidated maturing debts, and a total of about 2059.33 billion yuan in overdue commercial tickets.

In addition, China Evergrande disclosed the "Litigation Information" on November 29, 2023, and China Evergrande noted the announcement issued by Evergrande Property Group Co., Ltd. (a subsidiary of China Evergrande) on November 28, 2023, regarding its subsidiary Jinbi Property Co., Ltd. (referred to as "Jinbi Property"), including China Evergrande and three related subsidiaries, for the enforcement of its 2 billion yuan deposit certificate pledge guarantee by the bank. Approximately 1.9963125 billion yuan and approximately 152.0628 million yuan of provisional interest.

As of the date of the above announcement, China Evergrande and its related subsidiaries have not received notice of the lawsuit filed by the Intermediate People’s Court of Guangzhou City, Guangdong Province, China regarding Jinbi Property. China Evergrande will seek legal advice to safeguard the legal rights of China Evergrande. China Evergrande will issue further announcements on any material progress of the above litigation in due course. (Dong Tim)

关于作者