On Tuesday, the main contract of soda ash closed down 3.89%, closing at 2176 yuan/ton.

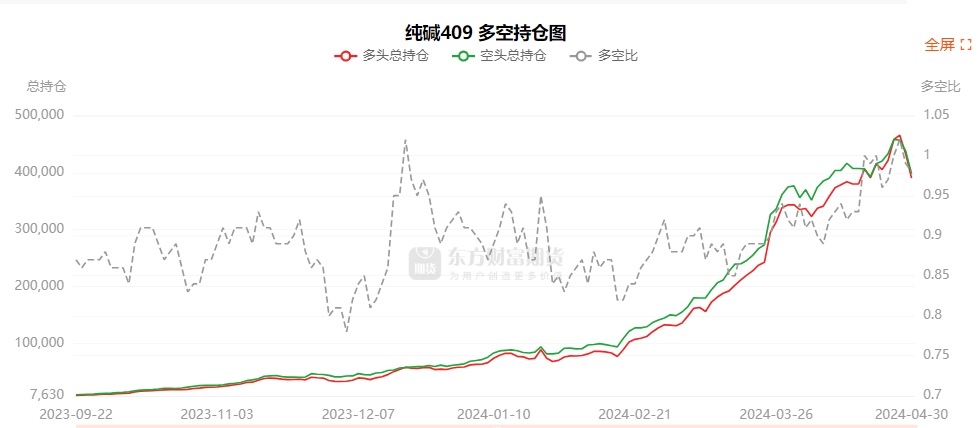

The positions held on that day were 727,270 lots, a decrease of 103,918 lots compared with the previous trading day.

During the day, the capital outflow was 1.369 billion yuan.

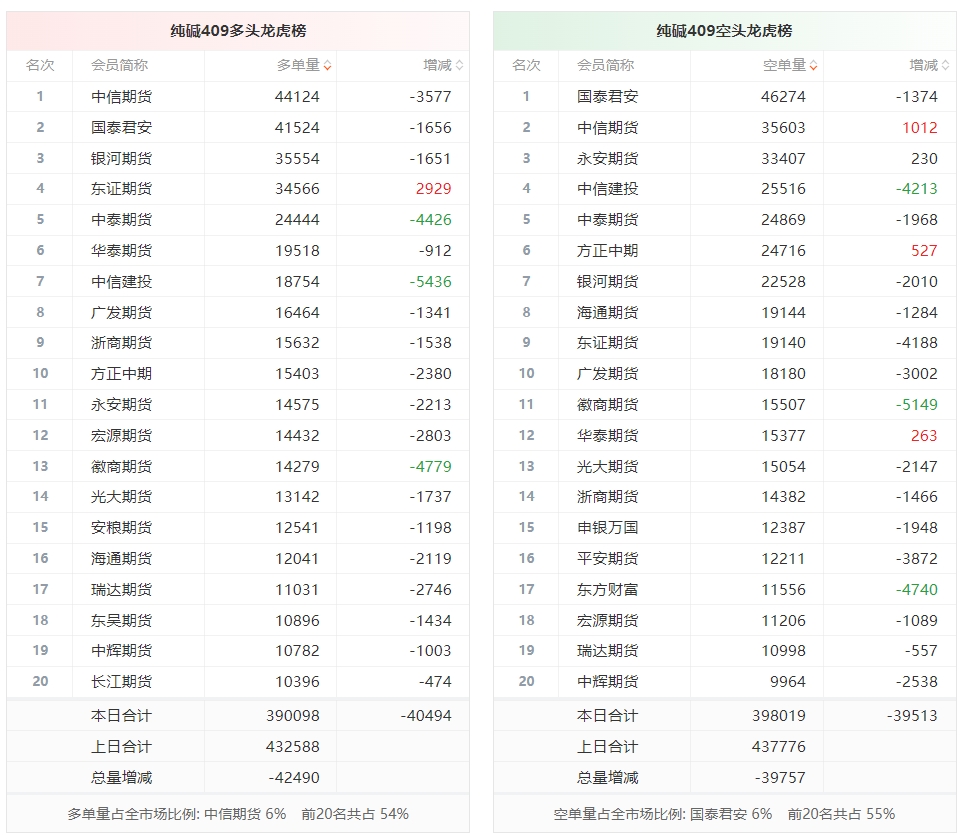

Today, there are 390,098 long positions in the top 20 seats, accounting for 54% of the whole market, among which CITIC Futures, the first long position, accounts for 6% of the whole market.

The top 20 short positions were 398,019 lots, accounting for 55% of the whole market, among which the short position was the first.Accounting for 6% of the total market.

The top 20 seats showed a net clearance of 7921 lots, an increase of 2733 lots compared with the net clearance of 5188 lots in the previous trading day.

As can be seen from the figure below, the net positions of the top 20 seats are in a clear position for a long time.

As far as bulls are concerned, the top 20 seats today have reduced their positions by 40,494 lots compared with the previous day, of which, Huishang Futures,Obviously, the positions of the three institutions were reduced by 5436 lots, 4779 lots and 4426 lots respectively.

As far as short positions are concerned, the top 20 seats today have reduced their positions by 39,513 lots compared with the previous day, among which Huishang Futures,、Obviously, the positions of the three institutions were reduced by 5149 lots, 4740 lots and 4213 lots respectively.

The data shows that within a weekPing An Futures and Soochow Futures are among the top gainers in soda ash, with profits of 68,605,200 yuan, 49,460,700 yuan and 33,556,200 yuan respectively.

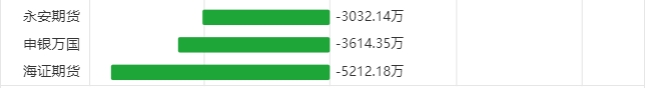

Within a week, Haizheng Futures, Shen Yin Wanguo,The loss of soda ash was the highest, and the losses of the three institutions were 52.1218 million yuan, 36.1435 million yuan and 30.3214 million yuan respectively.

Generally speaking, the soda ash 409 contract lightened its position today. Among the top 20 positions in long and short positions, both long and short positions showed an exit trend, and the willingness of long positions to exit was stronger than that of short positions.

关于作者